Achieving financial freedom hinges on building a robust investment plan that can weather market volatility and support your evolving financial needs. One of the most influential techniques for long-term success is asset allocation, spreading your investments among various asset classes to help manage risk, enhance potential returns, and safeguard your path to independence. With an effective asset allocation strategy for long-term goals, investors can confidently pursue major life milestones while minimizing avoidable setbacks.

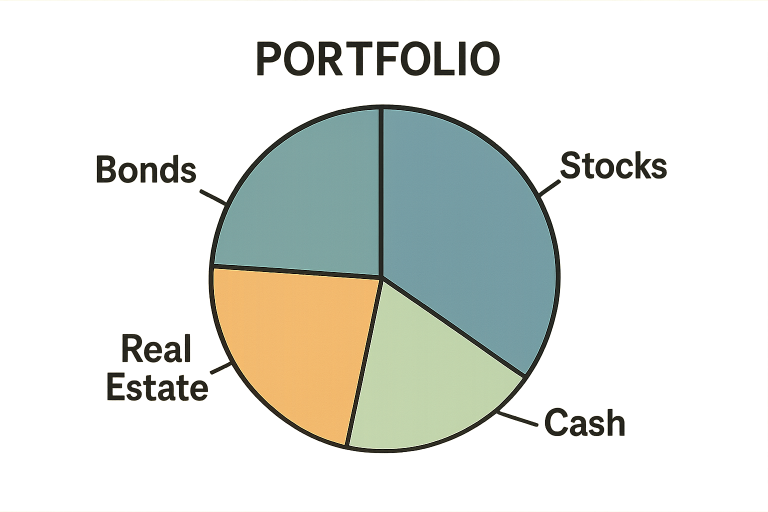

Proper asset allocation lays the groundwork for consistency and resilience in your financial journey. By thoughtfully allocating your investments across categories like stocks, bonds, real estate, and cash, you can not only capture growth opportunities but also shield yourself from the impact of downturns in any single sector. This dual focus on growth and protection is critical for anyone serious about securing a stress-free future. The more thoughtfully you diversify your investments, the better equipped you are to ride out market fluctuations and reach your financial targets efficiently.

Put simply, asset allocation works as a blueprint, guiding you to adjust your investment mix across life’s stages and changing market conditions. Whether you’re just starting or nearing retirement, aligning your portfolio with your unique objectives and risk comfort is a proven tactic for enduring success. Diverse portfolios, supported by regular rebalancing, are foundational for achieving both stability and long-term growth.

Menu list

Understanding Asset Allocation

Asset allocation isn’t simply about picking investments at random; it’s the inspired process of constructing a portfolio that aligns with your unique goals and appetite for risk. This division among stocks, bonds, real estate, and even alternative assets seeks to capture the upside of growth drivers (such as equities) while benefiting from the stability of income-generating assets (such as bonds).

The optimal mix is never “one-size-fits-all”; it’s personalized based on your target retirement date, cash flow needs, and psychological comfort with risk. Asset allocation offers a thoughtful approach to balancing your ambitions with realistic expectations, ensuring your strategy evolves as your life and the markets change.

Benefits of Diversification

Diversification, a natural extension of asset allocation, helps reduce the impact of poor performers in your portfolio by spreading investments across uncorrelated or less-correlated asset classes. While historically offering the highest returns, stocks can also experience significant volatility. Bonds, on the other hand, provide steady income and tend to hold up better during market downturns.

This balancing act smooths out the market’s ups and downs, resulting in more predictable returns over time. According to a Forbes expert, “Diversification can help you smooth out the market ups and downs and better manage risk.”

Strategies for Effective Asset Allocation

- Assess Your Risk Tolerance: Reflecting on how much risk you can handle emotionally and financially will help you determine if a portfolio weighted towards stocks or bonds is right for your needs. Risk tolerance can also change over time—review it periodically.

- Define Your Financial Goals: Clarity around your primary objectives, whether early retirement, funding a child’s education, or building generational wealth, guides your asset distribution and time horizon.

- Consider Your Investment Horizon: Longer investment horizons may allow greater exposure to equities, which can bounce back from downturns, while shorter horizons call for a more cautious approach with stable, income-focused assets.

Professional advice and robust tools, such as those provided by established financial publications, can make building and maintaining an allocation plan clearer and more efficient.

The Role of Rebalancing

Even the best-crafted allocation won’t stay balanced without routine maintenance. Market swings can unintentionally push your asset mix out of alignment with your intended goals. Regular rebalancing involves selling a portion of overperforming assets and buying more underrepresented ones, realigning your portfolio to its target proportions.

Frequent reviews ensure your portfolio’s risk remains in check and that shifting market dynamics don’t compromise your plan. A published article emphasizes, “Rebalancing is the process of adjusting your investments, like stocks, bonds, and cash, so they stay in the right mix for your needs.”

Tailoring Allocation to Life Stages

Your optimal asset allocation will shift over time as your lifestyle, obligations, and goals evolve:

- Early Career: At this point, prioritizing growth is key. Most investors lean heavily toward stocks to harness long-term compounding benefits.

- Mid-Career: As your earnings and responsibilities grow, balance becomes important, integrating growth with defensive, income-oriented investments.

- Pre-Retirement: Reducing volatility and preserving accumulated wealth take precedence. A larger percentage of bonds and cash equivalents becomes a prudent choice as retirement nears.

Common Mistakes to Avoid

- Neglecting Regular Reviews: Failing to review your allocation periodically may result in a portfolio that no longer aligns with your needs or risk profile.

- Overlooking Risk Tolerance: Investing beyond your comfort zone can cause stress and potentially lead to impulsive, costly decisions during market turbulence.

- Chasing Performance: Shifting strategies based on short-term trends is risky. A steady, disciplined approach based on long-term goals is most effective.

Final Thoughts

Strategic asset allocation remains a relentless driver of financial freedom. By methodically dispersing your assets, adjusting to life’s stages, and rebalancing in tune with both your objectives and economic changes, you build a firm foundation for lasting success. Stay disciplined, avoid common missteps, and let asset allocation steer you toward your most important financial milestones.